Woter is the next-gen, hybrid, decentralized exchange that shares revenue with token holders in smart contracts. Woter enables improvement over time of central exchanges with the safety and security of decentralization. For funding this project, WOT token holders shall receive a share of exchange revenues for life.

Introduction

We are in an era of technological advancements, blockchain, VR and more coming by the day, blockchain technology is more than currency or data storage or code execution medium, everyday we are finding new ways to embrace the blockchain and make use of it.

The WOTER project’s main focus is building an exchange for the people; you own this exchange simply by holding WOT coins/Tokens, WOT is an ERC20 ethereum token, our smart contract will interact with your wallet, check how much WOT tokens you have and gives you 25% of our shares depends on how much you are holding - this is the first coin that earns you ethereum for life.

Funds from the ICO will go directly to advertising, development and future projects, we will not stop with the exchange, we will build more blockchain related projects so that all WOT holders will enjoy exclusive income from for life as long as the ethereum network is up and running.

The Challenge

Cryptocurrency markets have grown enormously in recent years, from a daily trade volume of $60 million in January of 2015 to more than $8 billion in November of 2017. Despite the fact that most cryptocurrencies are secured by decentralized architectures, almost all trades between currencies take place on centralized exchanges, where funds must be deposited under the control of the entity facilitating exchange. This layer of centralization puts user funds at risk to hackers and platform managers. Most famously, millions of dollars worth of Bitcoin were stolen from Mt. Gox in 2011, and again from Bitfinex in 2016. Recently, decentralized exchanges have emerged to allow users to trade without giving up control of their funds.

Under these systems, trades are executed by smart contracts on a blockchain, removing the need for a centralized third-party to control user accounts. While these exchanges succeed at their primary goal of decreasing third-party risk, their success comes at the cost of a huge loss of trading performance. Smart contracts are far too slow to execute the complex matching logic of order books on high-volume, centralized exchanges. In practice, this means that users cannot execute complex trades, and presents opportunities for arbitrage on stale orders.

The Solution

If centralized exchanges provide speed, and decentralized exchanges provide security, then it seems natural to ask: can a hybrid system provide the best of both worlds? In this paper, we propose that.

WOTER exchange is secure and works within ethereum blockchain, smart contracts allow us to pay every WOT holder automatically, cannot be modified and it’s there for life, WOTER exchange will be accessible even if the main site goes offline, anyone can upload and launch it back, it’s an exchange system nobody owns, but to make it possible we are distributing WOT coins or tokens, it’s an ERC20 token, by holding it in your eth address you are earning ether for every exchange that takes place, 25% of the exchange revenue goes back to investors for life.

We are creating an earning opportunity for everyone – we are building a fiat/crypto exchange that is low in fees, and shares the revenue with holders of WOT token.

The Woter Exchange

Exchange Design Overview

The Woter network is a peer to peer network that manages the state of the order book of the exchange. In this document we will refer to a Woter node as a client, as it's more familiar from the user point of view and many will be firewalled. A Woter client can be anything with internet capability, e.g. a desktop application, mobile app, or web page.

The reference client will be a cross-platform desktop app, written in Python for rapidity of development and ease of porting.

Client Details

Each client holds a complete copy of the state of the Woter exchange, which is an order book made up of limit orders and spanning all currencies (crypto and fiat) that Woter supports. Without loss of generality, all limit orders are to spend x of X currency to buy at least y of Y currency. Woter fees and crypto/bank fees are deductible from both sides - x and at least y are always spent, but less than x will be received and less than y may be received.

The size of the state is modest by modern standards, there is no need for any client to keep a record of the history of the order book. Consensus between clients is achieved via Hashgraph[1], which ensures consistency even if up to a weighted third of the network doesn't follow the rules. The weight of a client is its disclosed proven stake in WOT. Thus initially clients operated by Woter founders have control over the network, but over time control will become more evenly distributed.

Client Directory

For clients to be able to communicate with each other, there needs to be a mapping from public key to IP and port. For privacy, the IP can be a proxy. The mapping may additionally contain proof of WOT stake and may additionally contain crypto payout addresses. This information is submitted to the Woter network by a client when it joins. The public key identifying a client may be long-lived but needn't be - the network supports a client joining, participating and then never coming back (with the same identity).

Certain Woter operations may only be valid if the client behind the IP and port can prove it controls the public key that identifies the client.

Arranging a Trade

Suppose Alice wants to exchange 1 BTC for LTC. She instructs her Woter client to prepare a limit order that says buy at least 10 LTC and she will pay 1 BTC for them, it's up to the client to decide a reasonable limit based on published exchange rates and/or the current order book. A Woter transaction is broadcast to the network to add the order to the order book. In practice, Alice sends the transaction to one or more non firewalled clients who will relay it to the rest of the network. To limit spam, the transaction includes proof Alice has the funds in the form of signatures.

The Woter network accepts the transaction provided those funds aren't already claimed by other orders. Woter network drops an order if it detects that the funding no longer exists, this is achieved via Electrum[2]-style servers. Meanwhile, or previously, or much later, Bob adds an order to spend 10 LTC for at least 1 BTC. (In practice Bob's order won't match Alice's precisely, but it's convenient for this description.) Both clients match the orders, not necessarily in the same way. Other clients on the network have no incentive to match the orders, except perhaps to pre-empt the trade to get a better deal for their own orders.

A Woter transaction is broadcast to the network to remove the matched orders from the book, replacing them with zero or more change orders.

Settling a Crypto/Crypto Trade

Alice now communicates directly with Bob over HTTPS, this is similar to Gnutella[3] in which the network is chiefly used to allow 2 peers to find each other. Alice prepares a BTC transaction to Bob with some additional inputs and outputs. One or more additional outputs pay a fee to WOT holders. One or more additional inputs are unsigned dust inputs from Woter network participants (discovered via the client directory) who will countersign the transaction.

Alice sends her BTC transaction to Bob, who can't broadcast it to the BTC network as it hasn't been countersigned. Similarly Bob prepares a LTC transaction, bundles it with Alice's BTC transaction in a Woter transaction and broadcasts it to the Woter network. The Woter network now validates that the new transaction satisfies the limit orders that were consumed and pays out the correct amount to WOT holders. If so, the nominated countersigners add their signatures and broadcast the BTC and LTC transactions to their respective networks.

The above mechanism assumes neither cryptocurrency has smart contract support, in which case Woter may use an enhanced mechanism to take advantage of that support.

Settling a Crypto/Fiat Trade

A lot like a crypto/crypto trade except that Bob sends fiat directly to Alice's bank account, like LocalBitcoins[4]. He has an incentive to do so once he has Alice's non-countersigned BTC transaction, as then proof of sending the funds is enough to convince the Woter network to countersign and release the crypto to him. Currently only Alice can supply such proof by declaring she has received the fiat.

In the future Bob's bank may support providing a signed statement that the funds were sent, which Bob can then submit to the Woter network as proof.

Market Making

It is possible to match an order even if there is no direct market with the target currency by making intermediate trades. This can be a value-added feature of the Woter client requiring minimal input from the user.

�

ICO Details

The WOT token is ERC-20 standard based Ethereum token. WOT tokens grant the holders the right to:

Receive 25% of profits generated from the WOTER Exchange operations for life which shall be distributed based on the WOT token holdings

WOTER might have to take business decisions that might require voting. WOT token holders can vote on such decisions that come up for voting.

ICO Summary

WOT tokens shall be offered for crowd sale for 45 days from 28 Apr 2018.

Token Symbol

WOT

Token Standard

ERC20 (Ethereum)

Token Issue Volume

100,000,000

Price Per Token

1 WOT = 0.25 USD

Soft Cap

$1,000,000.00 USD

Hard Cap

$15,475,000.00 USD

Pre-ICO Start Date

1 Mar 2018

ICO Start Date

28 Apr 2018

Additional notes:

Tokens sold in pre-ico & ICO will be priced in USD

Token Purchase Currency: ETH, BTC are the only currency, which will be accepted for Private sale purchases. We will provide you with the address to which ETH, BTC payments must be sent, after you complete the pre-registration process.

Please note: You must send ETH, BTC from a wallet in which you own the private key. DO NOT send BTC, ETH from an exchange.

Community Appreciation Early Access Sale Period: At the start of the “Community Appreciation Sale Period”, this period will be open only to the WOTER`s early adopters and active community members on a whitelist basis at WOTER`s sole discretion

Private PreSale

Eligibility to Participate in the private sale:

In order to be eligible to participate in the private sale, you must:

Comply with all the terms and conditions.

You must be 18 years old and over to participate in our pre-sale.

Register and provide all of the required Registration Information to WOTER.

Registration process details are available at https://woter.trade. Please read it carefully.

Make sure the website starts with https. If you find any other website, pretending to be the official Woter site, it is a scam. Our token will be sold only at https://woter.trade/

Token Distribution

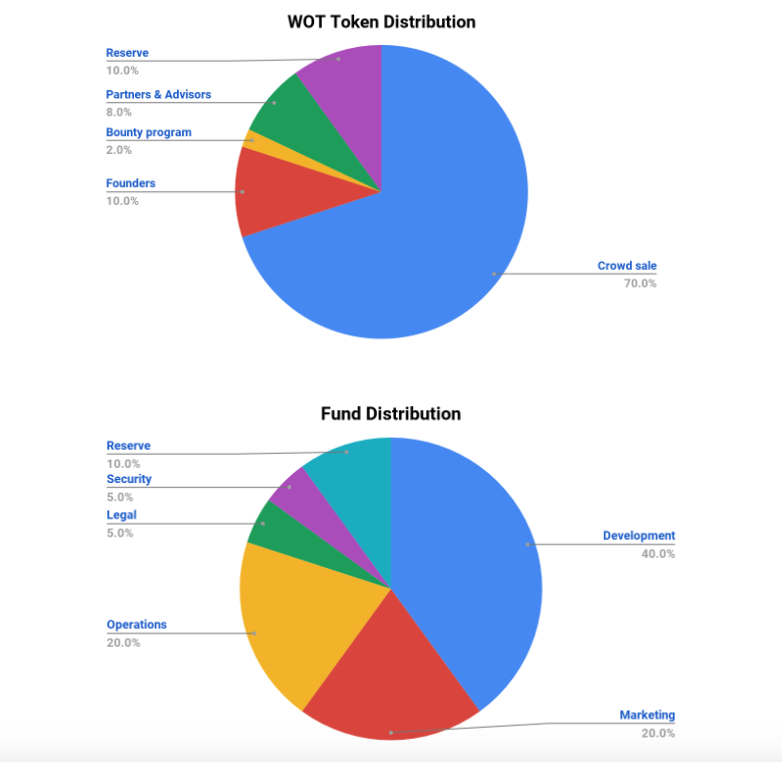

The tokens shall be distributed as per the below ratio:

70% - Crowd sale

10% - Founders

2% - Bounty program

8% - Partners & Advisors

10% - Reserve

Funds Distribution

The funds from the ICO proceeds shall be used as follows:

40% - Development

20% - Marketing

20% - Operations

Woter Roadmap

The current Woter roadmap is as given below:

Jan 2018

WOT Token Creation

100,000,000 WOT Tokens created

1 Mar 2018

Pre-ICO

WOT Tokens will be sold at discounted price and held on web wallet.

28 Apr 2018

ICO

WOT tokens ICO will take place for 45 days or till the allocated tokens are sold in full

Q3 2018

WOT Wallet Creation & WOT on Exchanges

WOT wallet will be available for the public, WOT shall be also added to exchanges.

Q4 2018

WOT Exchange Launch

WOTER Exchange will be launched supporting all major crypto and fiat currencies.

Jan 2019

Income Distribution Starts

25% income from WOTER Exchange shall be distributed proportionately with WOT token holders via smart contracts.

Beyond 2019

Dynamic Future

More projects will be built, and investors will be able to earn from all of those simply by holding WOT tokens. Future projects will be decided by top WOT holders and votes will be cast by all WOT holders.